Liberia: Suspension of CBL Executive Governor Faces Scrutiny as Bank’s Act Requires Impeachment

MONROVIA — President Joseph Boakai Tuesday suspended Liberia’s central bank governor after an audit found irregular loans to the government and unauthorized spending, Information Minister Jerolinmek Piah said during a press briefing Tuesday.

By Selma Lomax, selma.lomax@frontpageafricaonline.com

President Boakai’s decision was the result of an audit he commissioned of three key government institutions, including the central bank.

Mr. Aloysius Tarlue will be suspended indefinitely following the release last week of the General Auditing Commission’s (GAC) report, which focused on the period from 2018 to 2023.

President Boakai has, meanwhile, named Henry F. Saamoi as acting executive governor.

An executive Mansion release said the appointment takes effect immediately.

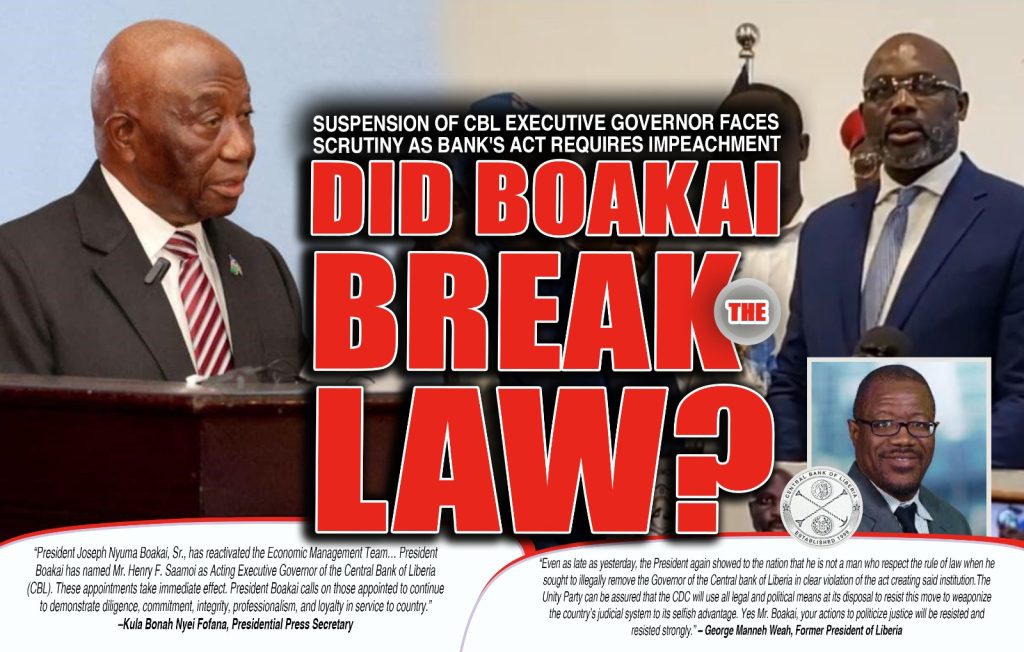

“President Joseph Nyuma Boakai, Sr., has reactivated the Economic Management Team… President Boakai has named Mr. Henry F. Saamoi as Acting Executive Governor of the Central Bank of Liberia (CBL). These appointments take immediate effect. President Boakai calls on those appointed to continue to demonstrate diligence, commitment, integrity, professionalism, and loyalty in service to country,” the release signed by Presidential Press Secretary Kula Bonah Nyei Fofana said.

“Reasons” for suspension

The GAC, in its audit, observed that the CBL management exceeded approved expenditure limits from Fiscal Year 2018 to 2022 by approximately $19.31 million. The audit also found that the approved budget expenditure projections consistently surpassed revenue projections, indicating a pattern of deficit financing.

The audit report disclosed that CBL management cashed several checks over the counter, violating standard banking regulations. Examples include payments of $8,500 to Vision Pro and $8,000 to the West Point Youth Association. According to regulations, institutional checks should be deposited, not cashed directly.

The GAC identified unauthorized financing activities, including a $50.2 million disbursement to the Government of Liberia’s payroll account on November 30, 2023, and an additional $32.85 million on December 23, 2023. These transactions lacked legislative ratification, contrary to Article 34 d (iii) of the 1986 Constitution of Liberia and Section 46.2 of the CBL Act of 1999. Additionally, there was no evidence of approval from the CBL Board of Governors.

The audit found significant issues with the management of non-performing staff loans, totaling US$472,053 for separated staff and US$240,634.80 for seconded staff.

Notable defaulters include former Finance Minister Augustine K. Ngafuan, owing $5,091.29, and Sinoe County Senator Crayton O. Duncan, owing $44,924.43. The GAC noted a lack of repayment, absence of legal action, and missing documentation for these defaulted loans.

Did Boakai act illegally?

President Boakai has been criticized by some Liberians including former President Weah for his action. They claimed that the president violated the CBL act.

In a landmark address on Wednesday, ex-president Weah said President Boakai’s action undermines the rule of law.

“Even as late as yesterday, the President again showed to the nation that he is not a man who respect the rule of law when he sought to illegally remove the Governor of the Central bank of Liberia in clear violation of the act creating said institution,” he said. “The Unity Party can be assured that the CDC will use all legal and political means at its disposal to resist this move to weaponize the country’s judicial system to its selfish advantage. Yes Mr. Boakai, your actions to politicize justice will be resisted and resisted strongly.”

According to the provided Section 22 of the Central Bank of Liberia Act, the suspension or removal of the Governor can occur under certain circumstances.

These circumstances state “the executive governor, non-executive governors or deputy governors shall be removed by the Senate from office only upon a bill of impeachment by the House of Representatives upon any of the following reasons, including gross breach of duty, misconduct in office, conviction of a felony, and being declared bankrupt”.

However, it’s important to note that the removal of the Governor requires the support of a two-thirds majority of the Senate, which would need to pass a resolution in favor of the removal or suspension.

Additionally, the Governor, Deputy Governor has the option to resign from their position by providing written notice to the President. If any of these positions become vacant due to death, resignation, or other reasons before the expiry of the term, a suitable replacement will be appointed in accordance with the prescribed procedures outlined in the CBL Act.

CBL independence

The suspension of the CBL Governor based on what many view as a political audit report raises concerns about the independence of the Central Bank of Liberia.

The independence of a central bank is crucial for maintaining monetary policy credibility, ensuring financial stability, and promoting investor confidence.

The central bank’s independence allows it to make decisions based on economic fundamentals rather than political pressures or interference. It enables the bank to act in the best interest of the country’s economy, free from short-term political considerations.

By insulating monetary policy from political influence, central banks can focus on maintaining price stability, controlling inflation, and promoting sustainable economic growth.

However, when a central bank governor is suspended or removed under circumstances that are not clearly defined in its Act, such as a “politically-motivated” audit, it raises questions about the motives behind the decision and the potential impact on the bank’s independence.

It is important to ensure that any investigation or decision regarding the central bank governor is conducted transparently, adhering to legal procedures and maintaining the principles of due process.

The post Liberia: Suspension of CBL Executive Governor Faces Scrutiny as Bank’s Act Requires Impeachment appeared first on FrontPageAfrica.